The Impact of Mental Health on Personal Finances and Debt Management

Understanding the Connection

It is crucial to acknowledge the profound relationship between mental health and personal finances. This link is often overlooked, yet it can have a significant impact on how individuals manage their finances and navigate daily life. Financial challenges can exacerbate mental health issues, while mental health struggles can, in turn, wreak havoc on one’s financial stability. This reciprocal relationship suggests that a lack of mental well-being can complicate tasks such as budgeting, saving, and managing debt, leading to a cycle that can be tough to break.

Common Impacts of Mental Health on Finances

- Impulsive spending: Many individuals engage in unplanned purchases during times of emotional distress. For instance, someone battling anxiety may choose retail therapy as a temporary escape, spending money they cannot afford.

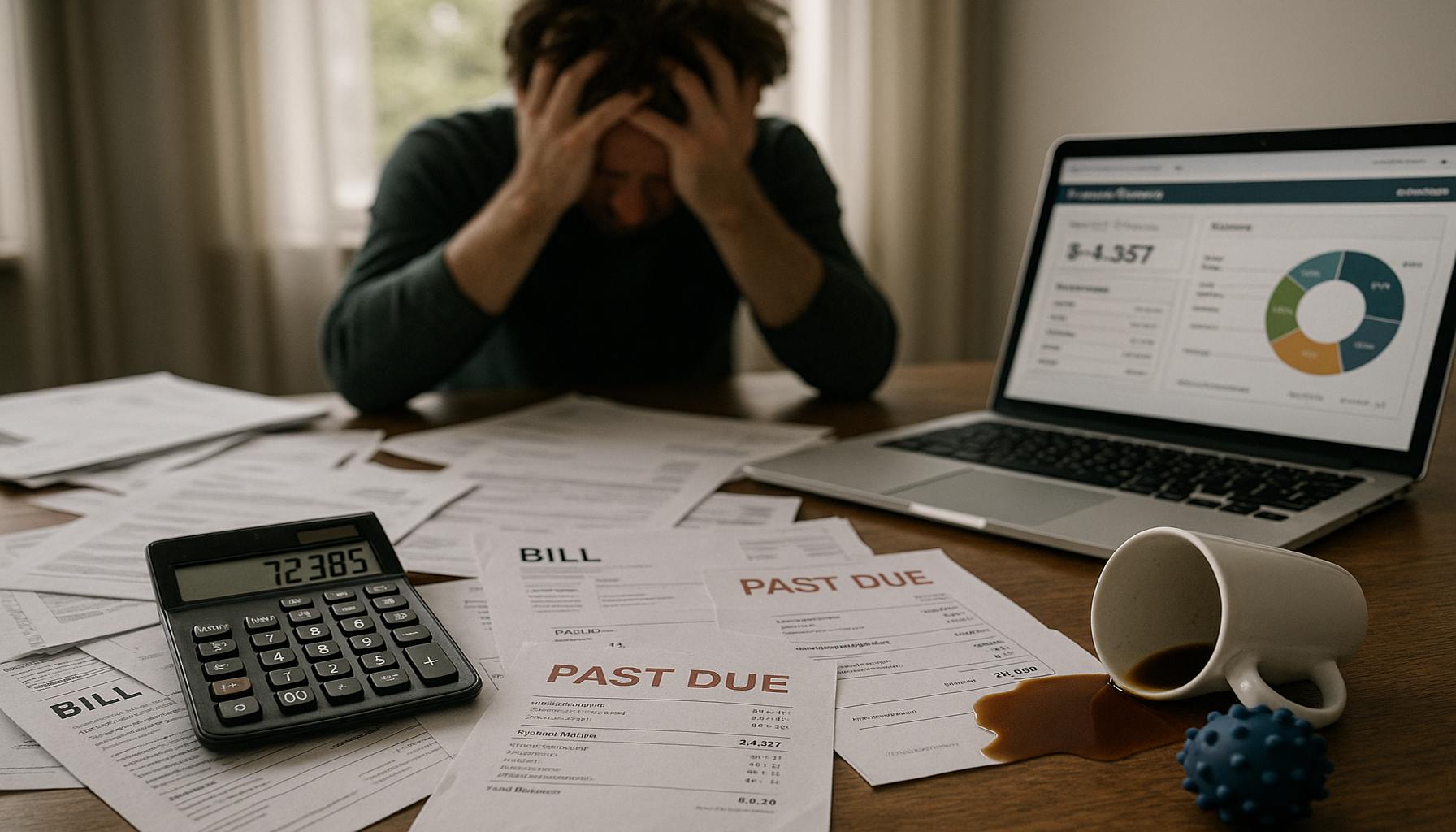

- Debt accumulation: Feelings of overwhelm might lead individuals to ignore bills or fail to prioritize debt repayments. An individual with depression may struggle to open bills or adjust financial commitments, leading to growing debt and increased stress.

- Job performance: Mental health challenges can hinder productivity and focus, impacting job performance. Poor job performance may result in missed promotions or even job loss, leading to financial instability.

Recognizing these challenges is an essential step towards reclaiming control over your finances. Many face these difficulties, which makes addressing both mental health and financial literacy imperative. By comprehensively understanding how these two areas intertwine, individuals can develop practical strategies to enhance both their financial health and emotional well-being.

Empowering Your Financial Journey

Empowerment is the driving force for meaningful change. Taking proactive steps toward understanding and improving your mental and financial health can lead to transformative outcomes. Embracing this connection presents many benefits:

- Improved decision-making: Achieving clarity in thought allows for more informed financial decisions. When mental state improves, individuals are likely to analyze spending patterns critically and make better choices.

- Stronger financial habits: Effective stress management contributes to better budgeting and saving. Practicing mindfulness can create a calm environment where one can thoughtfully plan their financial future.

- Greater overall well-being: Nurturing a healthy mental state fosters financial confidence. When individuals feel good about themselves, they are more likely to take the necessary steps to manage their finances effectively.

Ultimately, addressing the link between mental health and personal finances is not merely about eliminating debt or sticking to budgets; it is about fostering a balanced and fulfilling life. By taking charge of both aspects, individuals can create a brighter financial future while nurturing their emotional wellness. Taking even small steps can lead to significant changes, ultimately paving the way towards a more empowered and secure life.

DISCOVER MORE: Click here to learn how to spend consciously

Breaking the Cycle of Financial Strain

Understanding how mental health issues affect personal finances is vital for fostering a stable and healthy life. For many individuals, mental health challenges can lead to patterns of financial behavior that may seem puzzling or irrational from an outside perspective. However, grappling with anxiety, depression, or other mental health disorders can create internal barriers that make managing finances feel like an insurmountable task.

The Emotional Toll of Financial Stress

When faced with financial stress, it can be easy for individuals to feel trapped in a cycle of despair. As bills stack up and debts accumulate, feelings of hopelessness may start to overshadow one’s ability to respond effectively. The emotional toll of these circumstances often leads to the following negative outcomes:

- Increased anxiety: Constant worry about financial obligations can exacerbate anxiety levels, causing individuals to withdraw from seeking help or advice, leading to further isolation.

- Decreased motivation: Struggling with mental health can sap motivation, making it challenging to engage in proactive financial planning. A sense of helplessness can hinder a person’s initiative to seek debt solutions or financial education.

- Social stigma: The societal stigma surrounding mental health issues can make discussing personal finances even more daunting. Individuals may feel embarrassed to reveal their financial struggles, further compounding their stress.

Addressing these emotional hurdles requires a shift in perspective—recognizing that it is perfectly acceptable to seek support in managing both mental health and financial matters. Establishing a connection between these two domains can not only alleviate the weight on an individual’s shoulders but also sow the seeds for lasting change.

Finding Balance Through Awareness

The journey toward financial stability while navigating mental health challenges begins with awareness and self-compassion. Understanding that it is common for individuals to encounter financial struggles during difficult times can serve as a reminder that they are not alone in their experience. By acknowledging and validating these feelings, individuals can create a more conducive environment for finding practical solutions.

Some effective strategies for fostering both mental well-being and financial health include:

- Setting realistic goals: Establish achievable financial goals to focus on, rather than getting overwhelmed by the big picture. Small victories create a sense of accomplishment and contribute to financial confidence.

- Seeking support: Talking openly with trusted friends or professionals about financial woes can provide encouragement and accountability, making it easier to address concerns.

- Prioritizing self-care: Taking care of one’s mental health through exercise, meditation, or hobbies can create a mindset that is more receptive to effective financial management.

Recognizing and nurturing the connection between mental health and personal finances is an empowering step toward creating a more fulfilling life. By openly addressing these challenges, individuals are better positioned to reclaim control over their financial futures and cultivate a lasting sense of well-being.

DISCOVER MORE: Click here to learn how to apply

Building Resilience Through Financial Literacy

Understanding the interplay between mental health and personal finance is not merely about managing stress; it is about building resilience that empowers individuals to thrive. Financial literacy plays a crucial role in this resilience, as knowledge transforms apprehension into confidence. When individuals take proactive steps to educate themselves about financial matters, they can break free from the feelings of inadequacy and shame that often accompany mental health challenges.

The Role of Education in Overcoming Barriers

Financial literacy equips individuals with the tools needed to navigate complex financial systems, thereby reducing feelings of helplessness. Education on budgeting, saving, and debt management can mitigate the sense of overwhelm that frequently accompanies financial difficulties. Here are a few fundamental concepts that can have a transformative impact:

- Understanding credit: Knowledge about credit scores and reports is essential. Individuals must know what impacts their credit rating and how responsible borrowing can lead to more favorable loan terms in the long run. This understanding can ease mental burdens related to credit card debt and loans.

- Creating budgets: A practical budgeting strategy enables individuals to align their spending with their priorities. By documenting expenses, one can identify patterns of unnecessary spending that may be driven by emotional responses, thereby fostering healthier financial habits.

- Emergency funds: Establishing an emergency fund provides a safety net that can alleviate anxiety during unexpected financial setbacks. This buffer can reduce the tendency to view financial issues as insurmountable, thus promoting a more proactive mindset.

By engaging with these basic principles of financial literacy, individuals can experience a heightened sense of agency over their financial destinies. This newfound knowledge can lead to more responsible decision-making and diminish the emotional sway that debt and finances hold over one’s mental well-being.

Therapeutic Approaches to Financial Anxiety

In addition to financial literacy, incorporating therapeutic practices can enhance an individual’s ability to manage both mental health and financial challenges. Therapists and financial professionals alike recognize the profound connection between emotions and financial behaviors. Seeking support from a financial therapist, for example, can be a critical step in breaking down the psychological barriers that lead to poor financial choices.

Some therapeutic strategies include:

- Cognitive-behavioral techniques: These can help individuals reframe negative thought patterns about money, allowing them to approach financial situations with a fresh perspective.

- Mindfulness practices: Being present and mindful can ease anxiety related to finances. Techniques like meditation can help individuals appreciate their current financial state and plan for the future without overwhelming feelings of dread.

- Goal-setting sessions: Working with a therapist to set realistic financial goals can provide clarity and empower individuals to develop tailored plans that resonate with their emotional and financial needs.

Integrating therapeutic approaches into financial management empowers individuals to confront hurdles head-on. This confluence of emotional wellness and financial responsibility fosters an environment where personal growth becomes possible, allowing individuals to soar beyond the confines of their mental health impairments and financial worries.

DON’T MISS OUT: Click here for the full guide

Conclusion

The relationship between mental health and personal finance is undeniably profound, interweaving stress, anxiety, and emotional well-being with financial decision-making. Addressing these intertwined issues is paramount for fostering not only financial stability but also overall mental wellness. As we have explored, financial literacy emerges as a vital pillar in this journey, enabling individuals to take informed steps that can significantly reduce feelings of financial inadequacy and distress. By breaking down complex concepts such as credit management, budgeting, and the importance of emergency funds, individuals can transform overwhelming challenges into manageable tasks that build confidence and resilience.

Moreover, incorporating therapeutic approaches can enhance one’s ability to navigate this landscape. When individuals engage in cognitive-behavioral techniques or mindfulness practices, they open pathways to reframe their perspectives on money, fostering healthier financial habits. By taking proactive steps towards both financial education and emotional support, individuals can cultivate a sense of agency over their financial lives.

Ultimately, achieving a harmonious balance between mental health and financial management is not merely a goal but a continuous process of self-discovery and empowerment. As you embark on this path, remember that every step taken empowers you to take control of your financial destiny. Embrace the journey toward better financial wellness; it is an investment in your future, one that promises not just financial independence but also peace of mind.

Related posts:

The impact of inflation on long-term investments in the United States

How to Create an Efficient Budget for Debt Management: Practical Steps for Americans

The role of fintechs in the democratization of investments in the United States

The Effect of the Pandemic on Americans' Debts: Lessons Learned and Paths to Recovery

The Impact of Interest Rates on Debt Management: How to Protect Your Credit

The Importance of Financial Education in Debt Prevention: A Path to Financial Freedom

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.