How to Apply for Gem CreditLine Easy Loan Application Guide

Explore the Benefits of Gem CreditLine in New Zealand

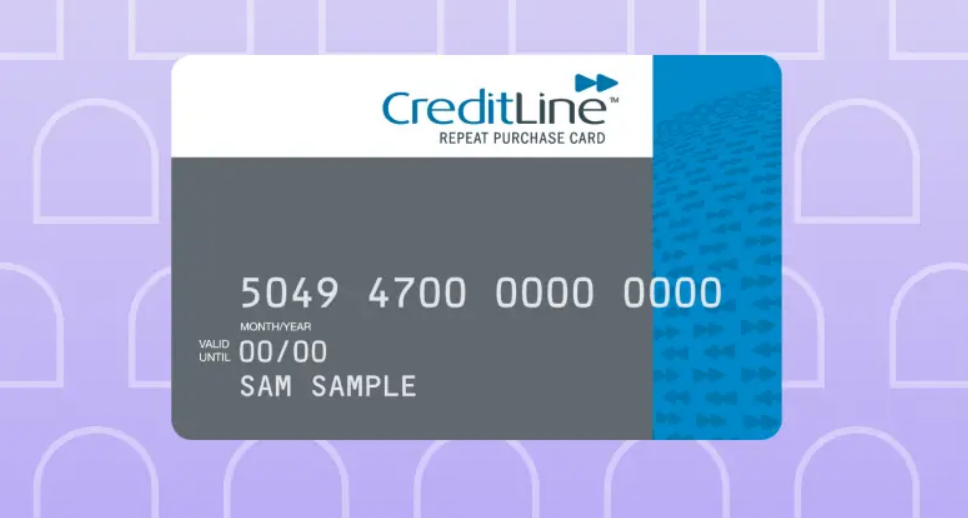

Are you seeking a way to handle your finances with the flexibility you need? The Gem CreditLine offers a distinctive opportunity for residents of New Zealand, adapting to the dynamic and vibrant Kiwi lifestyle. Unlike traditional loan products, this is a revolving credit line, which means once you’ve been approved, you can access funds whenever you need them without the hassle of repeated applications. This structure is ideal for both unforeseen expenses and significant planned outlays, making it a versatile tool for anyone needing financial adaptability.

Simple Application Process and Approachable Terms

The Gem CreditLine simplifies the application process, allowing for an easy and convenient online application experience. There’s no need to visit a branch or deal with extensive paperwork. With a focus on transparent fees and competitive interest rates, this credit line is an appealing option for many New Zealanders looking to manage their finances efficiently. These features help you maintain control over your borrowing costs, making it easier to plan your budget.

Versatile Financial Management Tool

This financial product is especially useful for bridging financial gaps between pay periods or for taking advantage of new business or personal opportunities without the red tape associated with conventional loans. Consider a situation where unexpected car repairs arise or when a once-in-a-lifetime travel deal pops up — Gem CreditLine offers the flexibility needed to seize such moments without financial strain.

Intrigued to Learn More?

With the Kiwi economy buzzing and opportunities abundant, ensuring you have a financial plan in place is crucial. The Gem CreditLine is here to support your goals by providing the confidence to spend when necessary, thanks to its adaptable structure. If you’re ready to explore how this unique financial tool can benefit your lifestyle, it’s time to look into its details and see how it can align with your financial needs.

Unlocking the Potential of Gem CreditLine

Flexible Credit Options

Gem CreditLine offers an array of flexible credit options, allowing cardholders the ability to control their finances more effectively. Whether you’re using it for day-to-day expenses or larger purchases, this features adapts to your needs. This flexibility is particularly beneficial as it enables you to manage your cash flow efficiently without the stress of stringent payment timelines.

Interest-Free Days

With Gem CreditLine, enjoy up to 55 interest-free days on your purchases. This benefit provides a comfortable period to settle your outstanding balance before interest begins to accrue, potentially leading to significant savings. To maximize this advantage, plan and organize your purchases to ensure they align within the interest-free period.

Worldwide Acceptance

Accepted globally, Gem CreditLine ensures you have a reliable payment method wherever you travel. This provides peace of mind and eliminates the need to carry multiple forms of payment when on international trips. Always remember to check for any potential foreign transaction fees to optimize the card’s global usage.

No Annual Fees

An added bonus for Gem CreditLine users in New Zealand is the absence of an annual fee. This makes the card an attractive choice for budget-conscious individuals who want to avoid additional costs. Utilizing the card for regular expenses while enjoying no yearly financial commitment could yield significant long-term savings.

LEARN MORE DETAILS ABOUT GEM CREDITLINE

| Feature | Benefits |

|---|---|

| Flexible Repayment Options | Tailored plans that suit personal financial situations, allowing you to manage your repayments effectively. |

| Competitive Interest Rates | Attractive rates that make borrowing more affordable, helping you save money over the term of your loan. |

The “Gem CreditLine” offers a suite of attractive features designed to enhance your financial flexibility. One significant aspect is the **Flexible Repayment Options**, which allow borrowers to adapt their repayment plans based on their unique financial circumstances. This adaptability can greatly reduce financial stress and pave the way for more confident fiscal management.Another appealing feature is the **Competitive Interest Rates** applied to the Gem CreditLine products, designed to provide an affordable borrowing solution. This means that not only can individuals access funds when needed, but also do so without the added burden of exorbitant costs. The combination of flexibility and competitive rates positions Gem CreditLine as an excellent option in the crowded financial marketplace.With more details available on these offerings, there’s a wealth of knowledge waiting for those interested in improving their financial wellbeing through judicious borrowing.

Requirements for Gem CreditLine Application

- Applicants must be at least 18 years old to qualify for the Gem CreditLine. This age requirement ensures that individuals have reached the age of majority and have a basic understanding of their financial responsibilities.

- A minimum income threshold is set to assess the applicant’s ability to repay the line of credit. While exact income requirements can vary, it ensures that the applicant can manage additional financial commitments.

- A respectable credit score is essential. A higher credit score indicates a reliable financial history, thus improving your chances of approval. This score reflects your past credit behavior and financial management patterns.

- Documentation required for application includes proof of identity and residency in New Zealand. Valid identification could be a passport or driver’s license, while proof of address might be required through utility bills or bank statements.

SEE HOW TO GET YOUR GEM CREDITLINE

How to Apply for the Gem CreditLine Card

Step 1: Visit the Gem Finance Website

Your journey to unlocking financial flexibility begins online. Head over to the official Gem Finance New Zealand website. On the homepage, navigate to the credit cards section and select “Gem CreditLine Card.” This will provide you with an overview of the card features, giving you a glimpse of how it can enhance your financial horizon with interest-free offers and online security.

Step 2: Fill Out the Online Application

Once you’re familiar with the benefits, it’s time to initiate the application process. Click on the “Apply Now” button, and you’ll be directed to the online application form. Make sure you have essential documents at hand, including proof of identity and income, to ease the application. Input your personal details carefully, ensuring their accuracy as this will set the tone for your application review process.

Step 3: Review and Submit Your Details

Take a moment to review your completed form. It’s crucial to cross-check for any inaccuracies because errors might delay the processing of your application. Upon satisfaction, hit the “Submit” button. Your application will then be sent for further verification by the Gem CreditLine team, who will assess your creditworthiness.

Step 4: Wait for Approval

Patience is key as your application goes through its evaluation. Typically, credit approval hinges not just on speed but on precision, ensuring that all submitted information corroborates with credit history checks. A representative might contact you for additional information if needed. If approved, you’ll receive confirmation via email along with your new card details.

VISIT THE WEBSITE TO LEARN MORE

Frequently Asked Questions about Gem CreditLine

What is Gem CreditLine and how does it work?

Gem CreditLine is a versatile credit card designed to provide flexibility and ease of use for New Zealand consumers. It allows cardholders to make purchases up to a predetermined credit limit and repay the amount over time. No interest is charged for six months on purchases over NZD 250, making it an attractive option for those looking to manage large payments without immediate financial stress.

Are there any fees associated with Gem CreditLine?

Yes, while Gem CreditLine offers several benefits, it is important to be aware of its associated fees. An annual account fee of NZD 52 is charged to maintain the account. Additionally, if you fail to meet the minimum payment requirements by the due date, a late payment fee may apply. Understanding these fees can help you better manage your expenses and avoid unexpected costs.

How can I apply for a Gem CreditLine card?

The application process for a Gem CreditLine card is straightforward. Interested individuals can apply online through the official Gem Finance website. You will need to provide personal information such as your identification details, income, and employment status. Approval is subject to lending criteria, and credit checks will be performed as part of the process.

What are the repayment terms and options available?

Gem CreditLine offers flexible repayment options to suit different financial situations. Cardholders can choose to pay the full balance by the due date to avoid interest or make minimum monthly payments, which would result in interest being charged on the outstanding balance. It is advised to check your monthly statements regularly to keep track of the due dates and amounts owed.

Is my Gem CreditLine card accepted internationally?

Yes, the Gem CreditLine card is widely accepted both domestically and internationally. It enables users to make purchases wherever credit cards are accepted. However, when using your card overseas, be mindful of foreign transaction fees that may apply. Always check the terms for any additional charges that could impact your overall travel expenses.

Related posts:

How to Apply for the American Express Airpoints Credit Card

How to Apply for BNZ Lite Visa Credit Card Easy Application Guide

How to Apply for Warehouse Money Purple Visa Card Quickly Easily

How to Apply for a Q Mastercard Credit Card Easily Online

How to Apply for ANZ CashBack Visa Credit Card Easy Steps Guide

How to Apply for a Westpac hotpoints Platinum Mastercard Credit Card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.